In the ever-evolving landscape of personal finance, new trends and strategies continuously emerge to make budgeting and saving money more engaging and effective. One such trend that has recently gained traction is the concept of ‘loud budgeting.’ This unconventional approach challenges the traditional, often mundane, methods of managing finances by infusing creativity, transparency, and a bit of flair into the budgeting process.

In this post, we’ll delve into the ‘loud budgeting’ viral trend, exploring how its unconventional methods can not only captivate attention but also serve as a powerful tool to help individuals save money and achieve financial wellness.

Understanding the ‘Loud Budgeting’ Trend:

At its core, ‘loud budgeting’ is a departure from the conventional, quiet, and sometimes secretive ways people approach budgeting. Instead of keeping financial matters hush-hush, this trend encourages individuals to be vocal, expressive, and even theatrical about their budgeting endeavors.

From creating budgeting spreadsheets with bold colors and emojis to sharing financial goals on social media platforms, ‘loud budgeting’ aims to turn the often-dreaded task of budgeting into an engaging and motivating experience.

Breaking Down the Elements of ‘Loud Budgeting’:

1. Visual Representation:

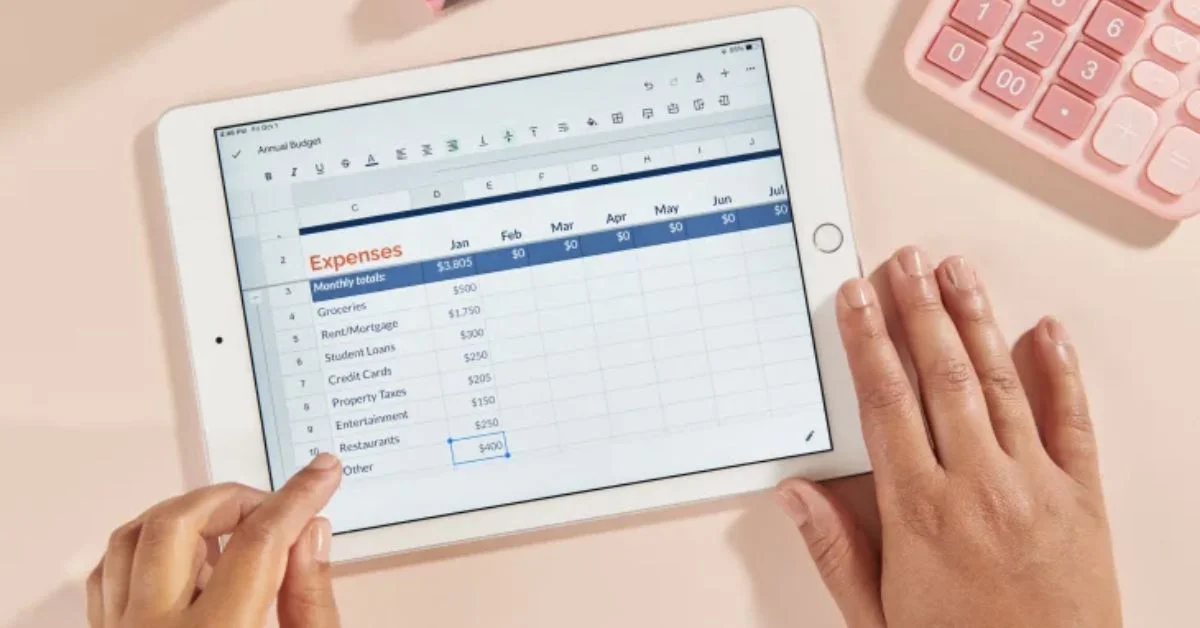

One of the key elements of ‘loud budgeting’ is the emphasis on visual representation. Traditional budgeting often involves rows of numbers and complex financial jargon. In contrast, ‘loud budgeting’ encourages individuals to create visually appealing charts, graphs, and infographics that vividly depict their financial goals, expenditures, and savings. This visual approach not only makes budgeting more accessible but also serves as a constant reminder of financial objectives.

2. Colorful Budgeting:

Gone are the days of dull spreadsheets with monotonous colors. ‘Loud budgeting’ introduces the use of vibrant and energetic colors to categorize expenses and income. Each color represents a different aspect of the budget, transforming what was once a mundane task into a visually stimulating experience. The use of colors helps individuals quickly identify where their money is going and fosters a sense of control over their financial journey.

3. Emojis and Icons:

Adding a touch of playfulness, ‘loud budgeting’ incorporates emojis and icons to represent different spending categories. Whether it’s a coffee cup for dining out, a shopping bag for retail therapy, or a travel icon for vacations, these visuals bring a sense of personality to the budget. The use of emojis not only simplifies tracking but also injects a dose of fun into the process, making it more enjoyable.

4. Social Media Sharing:

A distinctive aspect of ‘loud budgeting’ is its encouragement of sharing financial goals and achievements on social media platforms. Users create dedicated accounts or use personal profiles to showcase their budgeting journeys, sharing successes, challenges, and tips with a community of like-minded individuals. This element of accountability and camaraderie contributes to a positive and supportive environment.

The Psychological Impact of ‘Loud Budgeting’:

1. Increased Engagement:

Traditional budgeting methods can sometimes lead to disengagement and a lack of motivation. ‘Loud budgeting’ counteracts this by making the process more engaging and enjoyable. The visual elements, use of colors, and incorporation of social media create a dynamic and participatory experience that keeps individuals actively involved in managing their finances.

2. Transparency and Accountability:

Sharing financial goals publicly on social media platforms brings an added layer of transparency to the budgeting process. The public declaration of intentions creates a sense of accountability, motivating individuals to stick to their budget and make responsible financial choices. The supportive online community also offers encouragement during both victories and setbacks.

3. Positive Reinforcement:

The use of visuals, emojis, and social media sharing allows individuals to celebrate their financial achievements, no matter how small. This constant positive reinforcement helps build confidence and reinforces the idea that budgeting is not just about restriction but also about achieving financial milestones and fulfilling goals.

4. Reduced Financial Anxiety:

Traditional budgeting can sometimes contribute to financial stress and anxiety. ‘Loud budgeting’ seeks to alleviate this by fostering a more positive and empowering mindset. By transforming the budgeting process into a visually appealing and shareable experience, individuals may find that managing their finances becomes less daunting and more empowering.

Practical Tips for Incorporating ‘Loud Budgeting’:

1. Choose a Budgeting Platform:

Opt for a budgeting platform or app that allows for visual customization. Many modern budgeting tools offer features like colorful charts, customizable categories, and the ability to add emojis, making it easier to embrace the ‘loud budgeting’ approach.

2. Create Visuals That Speak to You:

Tailor your budget visuals to match your personal style and preferences. Whether you prefer a minimalist approach or enjoy a burst of colors, the key is to create visuals that resonate with you and make the budgeting process enjoyable.

3. Engage with the Online Community:

If you choose to share your budgeting journey on social media, actively engage with the online community. Participate in discussions, seek advice, and celebrate milestones. The encouragement and insights from others can enhance your own financial literacy and keep you motivated

Let’s celebrate this beacon of financial support and embrace the ripple effect of shared responsibility as we navigate the economic landscape together. Remember, knowledge is power, and with the right information, you can unlock the door to relief and pave the way for a brighter financial future.